If you started reading this article, congratulation. You have proven that you want your kids to have a wonderful life in financial terms and you are taking action to achieve it. For that to happen, though, they need to be taught some few lessons regarding the mindset and the practice that will lead them there.

We live in a society that has cultivated into us – advertisement after advertisement – to want lots of things and to want to have them now. Nevertheless, life is not about money. It is about gaining FREEDOM. Even when we say that it is the money we are after, it is the freedom to choose what we want to be and do whatever we want, that is behind our efforts. This is an important distinction and – I believe – can prove to be a real motivator in life.

I don’t know what is the age of your kids today- they might be at kindergarten or they are finishing high school, but I believe that they are never too young to start learning about the stuff that will make or break their life. And financial education is – unfortunately – outside of the school curriculum, so it is up to you to start talking about it at home. I am giving you here some ideas – very top of line but of amazing value – on how you can support your kids become financially happy.

- Tell your kids your financial truth – what you did well and what you did not so well. It is important to let your kids know what has worked for you and what did not. What you did wrong with your money? What would you do differently if you had the chance to change things? What else are you learning? You’ve got decades of real-life experience, so share what you’ve learned. Give the gift of your hard-won knowledge to someone you love. You may change his/her life forever.

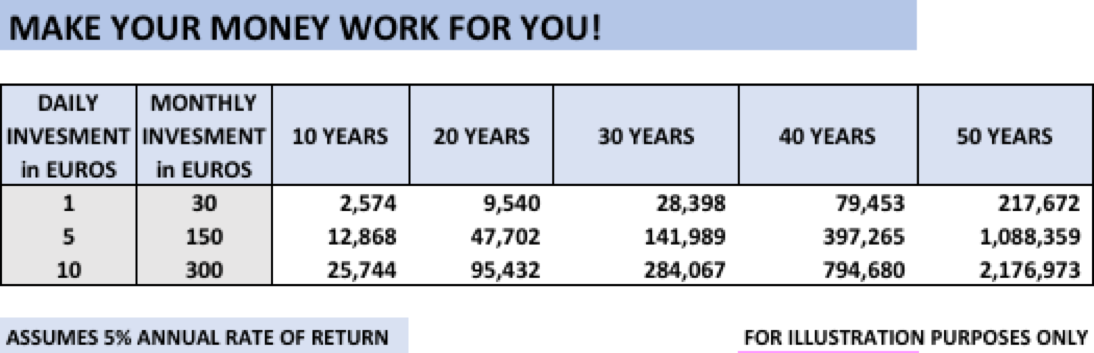

- Tell your kids they can become millionaires! Tell your kids it is easy to become a millionaire if they start saving when they are young. There is something call the compound interest that can help them do that. Explain it to them. Show them the math of the amazing pile of money they can accumulate just by saving a few dollars a month from the time they are in their first job. To help you do it I am including here a table with some examples.

This could be an amazing motivator for your kids, through creating the feeling that every day is meaningful and profitable. At the same time, you are securing that the people you love the most will be enjoying their life – without financial worries – now and in the future.

- If they can’t pay in cash for it, they should not buy it. Our kids are bombarded by idols that are stuffed with expensive watches and golden jewels. This are not the role models you want your kids to follow. Life has proven that many of these “stars” will be broke in ten years. It’s the truth, and your kids need to know it.

Teach your kids that the real reason they should be mindful of their money – instead of spending it on items they cannot really afford, is that saving leads to financial security, and financial security provides freedom. Explain how having money in the bank will give them the ability to do what they want to do, when they want to do it.

If they start soon using credit cards to buy stuff that otherwise they would not be able to afford, it is better that they think twice. Many children see their parents using credit cards carelessly – what they do not see is the stress and pressure that the resulting debt creates in their lives. Teach them how credit cards will use their brief vulnerability and will transform it into a-many-times-over debt, that compounds regularly and is impossible to pay. Explain how a bad credit record can affect their ability to get a job (if they are checked out by prospect employers), buy a home or car.

Teach them to use their cards for convenience – not to carry around cash, and pay it in full at the end of the month- the only reason that should justify their existence in their life.

- Teach them that if they don’t control their own destiny, someone else will. Too many parents raise their kids to go to school, earn good grades, and get a good job. I have news for you – this is not a formula for living rich. The rich teach their kids to be owners. The middle class teach their kids to be employees. Thus, teach your child to be an entrepreneur – and in all truth, these days it’s far riskier to be an employee than to be an entrepreneur.

In this uncertain and competitive world, entrepreneurship is the key to prosperity and security – and ultimately it will be the key to your child’s future. The world needs more dreamers, more doers, more builders, more leaders, more creators – and that means to a great extend to more entrepreneurs.

- Teach them to dream big dreams. The world needs more dreamers. We need our kids to believe and know that they really can be anything and anyone they want to be. Our greatest purpose in life is to use the gifts we have, to be who we were put here to be. For many of our kids, this means dreaming a life bigger than the one they are currently living. As an adult, our job is to be a dream creator, not a dream stealer. Your words of encouragement to a young person may shape not only his/her destiny, but the world’s. You don’t know who you are talking to when you speak to a young person. You might be speaking to the next Steve Jobs, Oprah Winfrey, or Elon Musk. You do not know what the child you love can do. Only he/she knows, or will know soon. So, encourage the dream!

Commit to yourself, right now, that you will do this. It might be one of the most important legacies you will leave behind.